Opinion: Apple's Untapped Bitcoin Revolution

Banking the Next Billion Users

Introduction

In 2007, Apple launched the first iPhone, effectively placing a computer into the palm of your hand. While still dominating the smartphone market and generating immense profits, Apple has faced mounting pressure to deliver its next revolutionary product. The Vision Pro seems to be ahead of its time, and projects like the Apple Car have been abandoned. Meanwhile, competitors like Microsoft, Google, and Meta push forward with advanced AI and large language models. The tech giant's innovation engine appears to be slowing just as the digital economy demands bold new directions.

As Apple approaches $4 trillion in market capitalization, a massive untapped opportunity lies hidden in plain sight. The company that revolutionized personal computing, mobile phones, and digital payments is uniquely positioned to transform global finance. Just as the iPhone democratized access to information, Apple could revolutionize banking through Bitcoin integration—potentially reaching billions of users who remain locked out of traditional financial services. This transformation requires three strategic moves: integrating Bitcoin payment cards into Apple Wallet, accepting Bitcoin as payment across Apple's ecosystem, and adding Bitcoin proceeds to its treasury reserves.

The stakes couldn't be higher. While Apple's competitors chase artificial intelligence breakthroughs, the company has a chance to take a different fork in the road— by banking the next billion users. Here's how Apple could unlock this trillion-dollar opportunity.

Step 1: Integrate Bitcoin Payment Cards into Apple Wallet

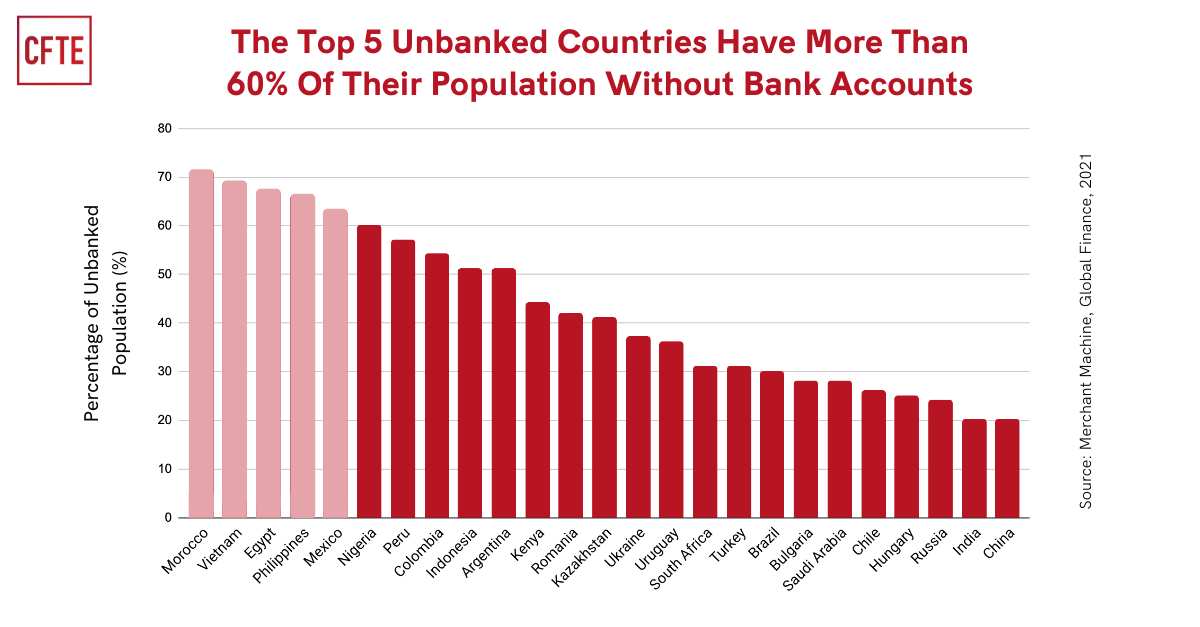

Apple Wallet has made credit card transactions seamless—users can pay with just a tap of their iPhone or Apple Watch. However, this convenience assumes access to traditional banking, a privilege millions globally lack. According to data from Global Finance, countries like Morocco, Vietnam, and the Philippines have over 60% of their populations unbanked, with limited access to card transactions and banking infrastructure. Bitcoin offers a solution by enabling financial services without requiring traditional bank accounts. By integrating Bitcoin payment cards into Apple Wallet through strategic partnerships with companies like PayPal’s Venmo, Coinbase Wallet, and Square’s Bitkey, Apple could provide financial inclusion to these underserved populations. This move would not only expand Apple’s user base but also position it as a leader in democratizing global finance through innovation.

Step 2: Accept Bitcoin as Payment Across Apple’s Ecosystem

Building on Tesla's precedent with cryptocurrency payments, Apple has a unique opportunity to boost its revenue by accepting Bitcoin. This move could open the floodgates to Bitcoin transactions, by serving the unbanked, young, and affluent. These key demographics are much more likely to own cryptocurrencies. Apple's brand loyalty and payment infrastructure would facilitate this integration across physical stores and the digital App Store, making transactions as simple as tapping an iPhone. This seamless approach would attract the cryptocurrency community and encourage existing Apple users to explore Bitcoin as a medium of exchange, potentially boosting revenue through transaction fees, retail purchases, and App sales.

Step 3: Store Bitcoin Proceeds as Treasury Reserve Assets

The true financial opportunity lies in storing this new Bitcoin revenue stream as a treasury reserve asset. While some companies, such as Tesla and MicroStrategy, have already adopted Bitcoin as part of their treasury strategy, others remain hesitant. For instance, Microsoft shareholders recently rejected a proposal to consider Bitcoin reserves, reflecting caution among major tech firms. By contrast, Apple has a history of embracing bold, transformative ideas, zigging when Microsoft zags. Holding Bitcoin reserves could align with its innovation-driven ethos, serving as both an inflation hedge and a strategic growth asset poised for future appreciation.

Conclusion

By embracing Bitcoin through Apple Wallet integration, payment acceptance, and treasury reserves, Apple can ignite a powerful flywheel effect. Integrating Bitcoin payment cards into Apple Wallet would bring financial services to millions of unbanked users, expanding Apple's reach and increasing transaction volumes. Accepting Bitcoin in both retail and digital stores would boost user activity and loyalty, making Apple's ecosystem a preferred destination for cryptocurrency users. Storing Bitcoin proceeds in its treasury would also offer substantial long-term financial benefits by leveraging Bitcoin's growth potential. This self-reinforcing cycle of adoption, engagement, and investment would drive Apple's innovation and establish a new Bitcoin standard in digital finance.